Najlepsze innowacje w zakresie cewki ze stali nierdzewnej i trendy rynkowe w 2024 r.

W szybko zmieniającym się świecie materiałów przemysłowych cewka ze stali nierdzewnej nadal jest kluczowym elementem w różnych sektorach, od przyrządów medycznych po budownictwo i energię.Rok 2024 przyniósł znaczący rozwój technologii produkcjiOto dogłębne spojrzenie na najważniejsze trendy i postępy w sektorze celików ze stali nierdzewnej.

1Nowe normy krajowe podnoszą jakość i wydajność

W związku z powyższym Komisja stwierdziła, że w odniesieniu do chińskiej produkcji stali nierdzewnej w okresie objętym dochodzeniem nie ma znaczącego wpływu na jej jakość i klasyfikację.Zrewidowana norma wprowadza ponad 30 nowych gatunków stali nierdzewnej, w tym SUS835 i SUS916, przy jednoczesnej optymalizacji odporności na korozję i wydajności obróbki istniejących stopów2.

W szczególności,aktualizacja zwiększa zawartość chromu w SUS304 do 18% dla maksymalnej odporności na korozję - kluczowa poprawa dla zastosowań medycznych, w których sterylizacja i odporność na chemikalia są najważniejszeStandard wprowadza również bardziej rygorystyczne wymagania środowiskowe, ograniczając szkodliwe substancje, takie jak ołów i kadm,tworzenie nowszych celików ze stali nierdzewnej bezpieczniejszych dla zastosowań medycznych i żywnościowych2.

2Indyjskie cła antydumpingowe zmieniają strukturę handlu

W znaczącym rozwoju handlu,Indyjska Dyrekcja Generalna ds. Odpowiedzialności Handlowej (DGTR) wydała w sierpniu 2024 r. ostateczne stanowisko w sprawie ceł antydumpingowych na przywóz stali walcowanej na gorąco (HRC) z Wietnamu.Podczas gdy większość wietnamskich producentów podlega cłoom antydumpingowym w wysokości 121,50 USD za tonę, grupa Hòa Phát otrzymała zwolnienie ze względu na minimalny margines dumpingu wynoszący 0-10%1.

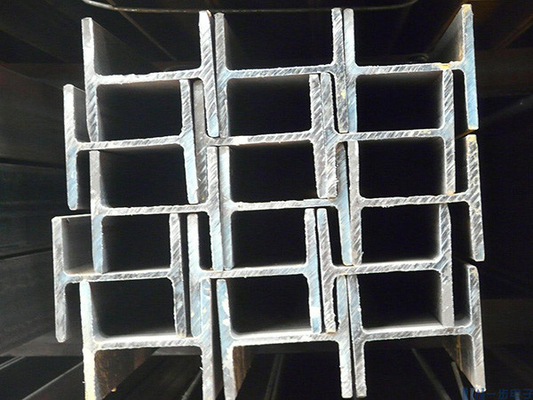

This decision gives Hòa Phát a competitive edge in the Indian market and ensures downstream manufacturers using their HRC can continue exporting to India without trade-remedy or origin-related barriersCła mają zastosowanie do stopu HRC ze stopu stopowego i niestopowego o grubości do 25 mm i szerokości do 2100 mm, objętych kodami HS 7208, 7211, 7225 i 72261.

3Postęp technologiczny w produkcji

Przemysł ten był świadkiem znacznych inwestycji w technologię produkcji, których celem jest poprawa jakości i zrównoważonego rozwoju.Południowoafrykańska firma Scaw Metals niedawno wyprodukowała swoją pierwszą płytę i cewkę w nowym kompleksie fabrycznych w Johannesburgu., wykorzystując nowoczesne technologie Danieli Green Steel10.

Nowy obiekt obejmuje pionowo zakrzywione, jednobłonkowe koło płytkowe i piec podgrzewający z logiką palenia PHL, który zapewnia wysoką elastyczność, maksymalną efektywność energetyczną i zmniejszoną emisję.Kompleks obejmuje również zaawansowaną instalację oczyszczania wody oraz nową instalację do topienia złomu i DRI, pozwalającą na pozycjonowanie obiektu do produkcji zielonej stali10.

4Rosnące zapotrzebowanie w zastosowaniach medycznych i specjalistycznych

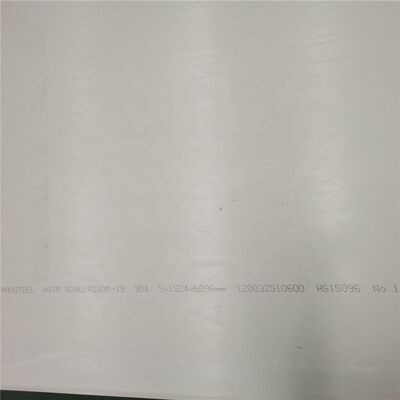

Sektor instrumentów medycznych nadal napędza popyt na wysokoprecyzyjne cewki ze stali nierdzewnej o szczególnych właściwościach.Dostawcy oferują obecnie specjalistyczne cewki ze stali nierdzewnej 304/304L z wykończeniem 2B specjalnie dostosowane do zastosowań medycznych5.

Materiały te charakteryzują się:

-

Technika walcowania na zimno dla lepszej jakości powierzchni

-

Tolerancja ± 1% dla produkcji precyzyjnej

-

Krawędzie szczelin dla poprawy wydajności przetwarzania

-

Certyfikacje, w tym ISO, RoHS dla zgodności medycznej5

Rynek odnotował wzrost popytu na cieńsze mierniki, przy czym wyświetlane 0,8 mm cewki ze stali nierdzewnej 304L zyskują na popularności w specjalistycznych zastosowaniach przemysłowych i medycznych5.

5Rozszerzenie zdolności produkcyjnych i dostosowanie łańcucha dostaw

Główni producenci cewki nierdzewnej rozszerzają swoje moce produkcyjne i poprawiają zdolność reakcji łańcucha dostaw.000 sztuk z czasem dostawy 15-20 dni3.

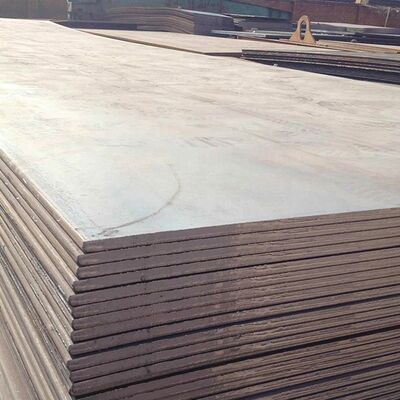

Firma wykorzystuje zaawansowane urządzenia do walcowania pięciu-ośmiu rol i walcowania na zimno, wspierane przez zaawansowane urządzenia do przetwarzania i wykrywania, które zapewniają lepszą jakość produktu.Ich asortyment produktów obejmuje cewki i arkusze ze stali nierdzewnej 201/304 z różnymi wzorami grawerowanymi i rebusowanymi, z powierzchniami dostosowanymi do wymagań klienta3.

6Perspektywy rynku i prognozy wzrostu

Przewiduje się, że światowy rynek drutu ze stali nierdzewnej, który obejmuje produkty z cewkami, będzie znacząco rosł, osiągając ostatecznie CAGR 6,7% zgodnie z analizą branżową6.Wzrost ten wynika głównie z rozszerzania zastosowań w produkcji samochodów, gdzie drut nierdzewny jest stosowany do wzmocnienia opon i produkcji układów przesyłowych, kół stalowych, układów wydechowych, siedzenia i układów drzwi samochodowych6.

Przemysł ten nadal stoi w obliczu wyzwań, w tym dostosowania polityki handlowej, zmienności cen surowców i rosnących wymagań w zakresie ochrony środowiska.innowacje technologiczne i rozwój zastosowań w zakresie energii odnawialnej, technologii medycznych i zaawansowanej produkcji nadal tworzą nowe możliwości rozwoju rynku.

Wniosek

Sektor cewki ze stali nierdzewnej w 2024 r. charakteryzuje się innowacjami technologicznymi, zmieniającą się polityką handlową i rosnącymi wymaganiami dotyczącymi zastosowań.Producenci, którzy mogą dostosować się do nowych norm jakości, poruszać się zmieniającym się krajobrazem handlowym i spełniać coraz bardziej zaawansowane wymagania takich sektorów jak instrumenty medyczne, będą najlepiej przygotowane do osiągnięcia sukcesu na tym dynamicznym rynku.

Twoja wiadomość musi mieć od 20 do 3000 znaków!

Twoja wiadomość musi mieć od 20 do 3000 znaków! Proszę sprawdzić email!

Proszę sprawdzić email!  Twoja wiadomość musi mieć od 20 do 3000 znaków!

Twoja wiadomość musi mieć od 20 do 3000 znaków! Proszę sprawdzić email!

Proszę sprawdzić email!